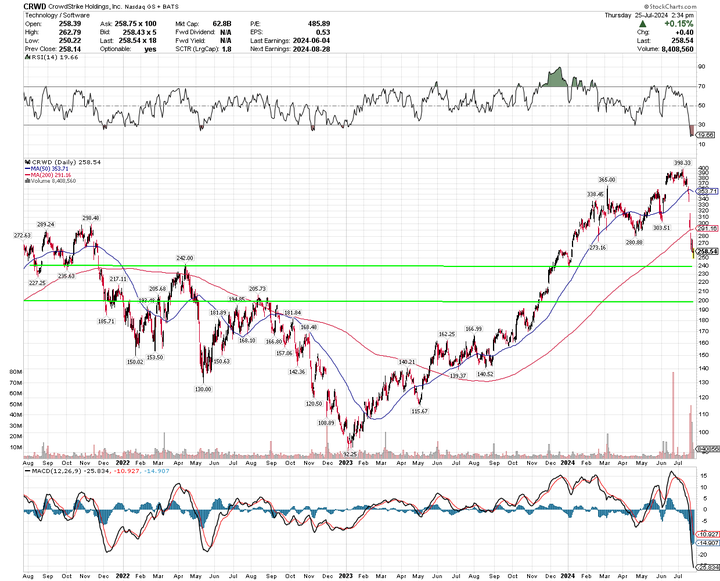

If you’re buying a stock for the long term (3-5 years plus), it’s good to buy below the 200-day moving average. CRWD is below that (red trend line) now. So this is a true trend reversal you can buy into.

There is some support in the chart at $240 and then $200. After that, support is at $140 and $100. These are the rough areas where you’d want to build up your position and think about adding on.

I haven’t followed the company closely (haven’t listened to calls or done research), but my impression is that they are the #1 in Cyber Security and doing well. They are, at my first glance, the only true security-only company in the top 10 of this list for instance: Largest IT security companies by market cap.

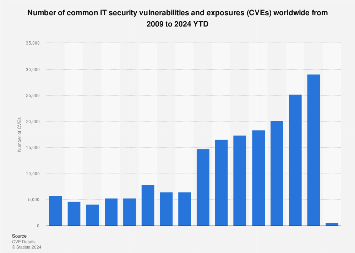

Cyber security is a huge trend. The number of vulnerabilities found, and spending on cyber security is going up 100%+ a ton every year. Like most people in tech, I feel like this stuff will be more and more important as more of our lives become digital.

(I remembered a chart from a recent conference that showed vulnerabilities doubling recently, but I can’t find it now. It might have been a subset of vulnerabilities. Statista here has “common vulnerabilities” it growing rapidly, but not 100%+.)

AI/LLM technology will improve both the tools used to find vulnerabilities as well as the bots that exploit vulnerabilities. That tech will also be used to fix vulnerabilities and combat bots… but all that means more money spent in this space, which should benefit CrowdStrike.

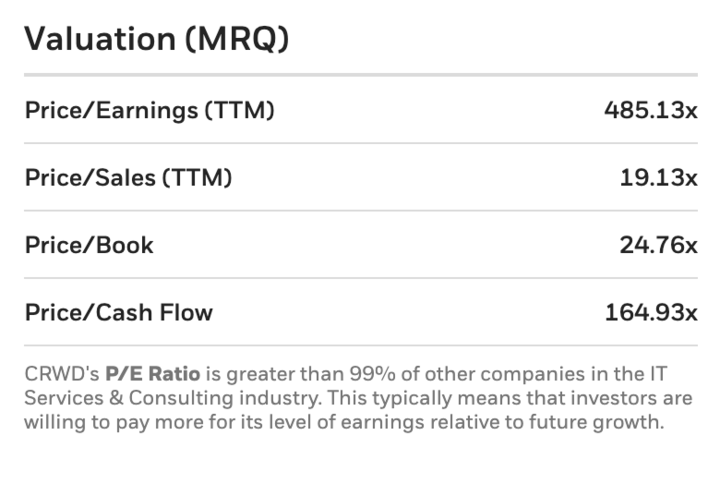

The stock is still priced high. Everything depends on the underlying company, and especially GROWTH. In general, PEs above 30 are high, above 100 are nuts. But sometimes companies are focused on revenue and not profit. In that case, sales multiples above 5 are high, and above 10 are nuts. A rare few companies are growing fast enough to have PS above 10. For comparison:

- GOOGL has a PS of 7.5.

- Nvidia has a PS of 38.48.

- CRWD has a PS of 19.13.

CRWD still, after this giant drawdown, has a PS of 19.13. So still a bit frothy.

Let’s see if revenue growth supports that PS.

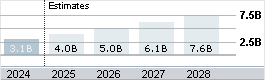

This is decent growth: 30% estimated this year, then like 20-25% per year. If you give them credit for doubling sooner than 2028, they still have a PS of 10. This may be worth it, but you start to get into the area where for this company to justify the stock price it has, they have to grow revenue faster than what is currently estimated.

So either:

- The security market will grow faster than expected,

- They will get more market share than expected,

- They will have some new product or offering that brings in revenue that isn’t expected.

My guess is that there is a premium on the stock because of buyout potential. The Wiz deal with Google just fell through. People maybe expect Google, Amazon, Microsoft, etc., to have to buy one of these companies. Or maybe the government contract stuff is expected to grow huge. I don’t know. I’d have to follow the news closer.

Nvidia has a much larger PS, but for comparison, here are the revenue estimates for NVDA.

They are expected to double THIS YEAR, then double again within 3 years. So 4x in 1-4 years, which would put them at a PS below CRWD. So, in effect, the current stock price in CRWD (after the big pullback) is still more bullish than the NVDA price from a revenue growth perspective.

I would wait for $140 or $100 without better knowledge or modeling for how they grow faster than expected.

I bet my own feelings for how big and important cyber security is… is higher than the average Wall Street analyst. So maybe if I did my own revenue growth estimates, they would be higher than expected and make buying worth it. But I’d want to know more before digging in.

Additional Thoughts on Long-Term Investments

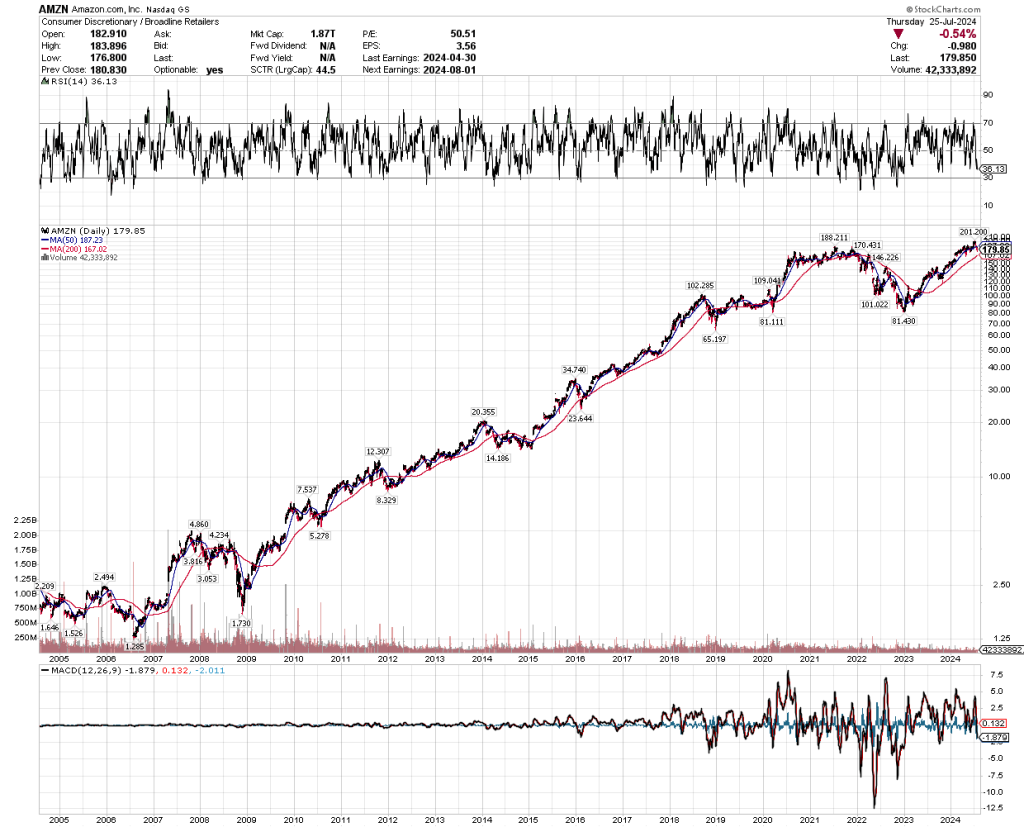

Regarding the “buy whenever it’s below the 200DMA” strategy, I don’t know if CRWD is one of these companies, but if it’s a giant like Google, Apple, Amazon, Nvidia, etc., these companies don’t spend a lot of time below the 200DMA. So you just gobble it up whenever it touches there and hold for 10+ years.

Amazon had more trouble than other tech companies through COVID, so it looks rough at the end there, but it was one of those stocks that basically was never on sale.

Anyway if you think CRWD is a generational company, and you plan to hold for 10 years, buying whenever it’s below the 200DMA is a decent idea. If you follow the technical analysis, the stock has closed multiple sessions below the 200 DMA. It’s broken in the short term and you could try to average in to get lower prices until it reverses.