As we enter (or exit?) this bear market in stocks, there will be some buying opportunities.

How do you know if that stock that just fell 80% is "on sale" or not?

This is not investment advice, but an example 🧵 on how I calculate "fair value" for a stock before investing in it.

I'm investing for the long term, 5-10 years out. If I'm not committed to holding that long, I pass on the stock.

So calculating fair value for me means estimating what the price of the stock will be 10 years from now, and then seeing if the current price makes that worth it.

Once I calculate fair value, I look to buy when the price is below that value… and look to sell when the price is above that value.

Sounds easy. Let's see how it works with a specific stock: $SNOW

Snowflake ($SNOW) is a "cloud computing–based data warehousing company". They help companies with tons of data to use that data more effectively. They want to help some of them sell that data. And in general, they may become a required service for all big companies.

They just IPO'd in 2020. Their stock shot up $387 a share, and recently has dropped to $126. Is it cheap now?

In terms of market cap it shot up to about $120b and is around $40b now.

Let's calculate fair value to find out if we should buy.

We could do this by trying to estimate earnings out 10 years or sales (revenue) out 10 years. Since Snowflake is a young company, with negative EPS, let's use sales.

They've been growing sales rapidly, one of the fastest growing businesses ever.

Sales have grown from $96m in 2019 to $1.2B in 2022. But remember their market cap is $40b, that's 33x sales.

For reference, Google stock is 5x sales. The Nasdaq average is around 6x sales. Someone recently said sell any stock that is > 10x sales. Sounds good in a bear market.

But Snowflake is growing fast, maybe fast enough to warrant the high sales multiple. If they grow 10x again over the next few years, then their sales multiple is only 4x, which is inline. We're investing for 10 years out, so maybe can wait for that.

So that's what I'll do, try my best to estimate Snowflakes revenue growth.

(Going to dinner, so will need an intermission on this. If I don't tweet now, I'm pretty sure the thread will disappear.)

Back from dinner. Let's calculate $SNOW's rev growth.

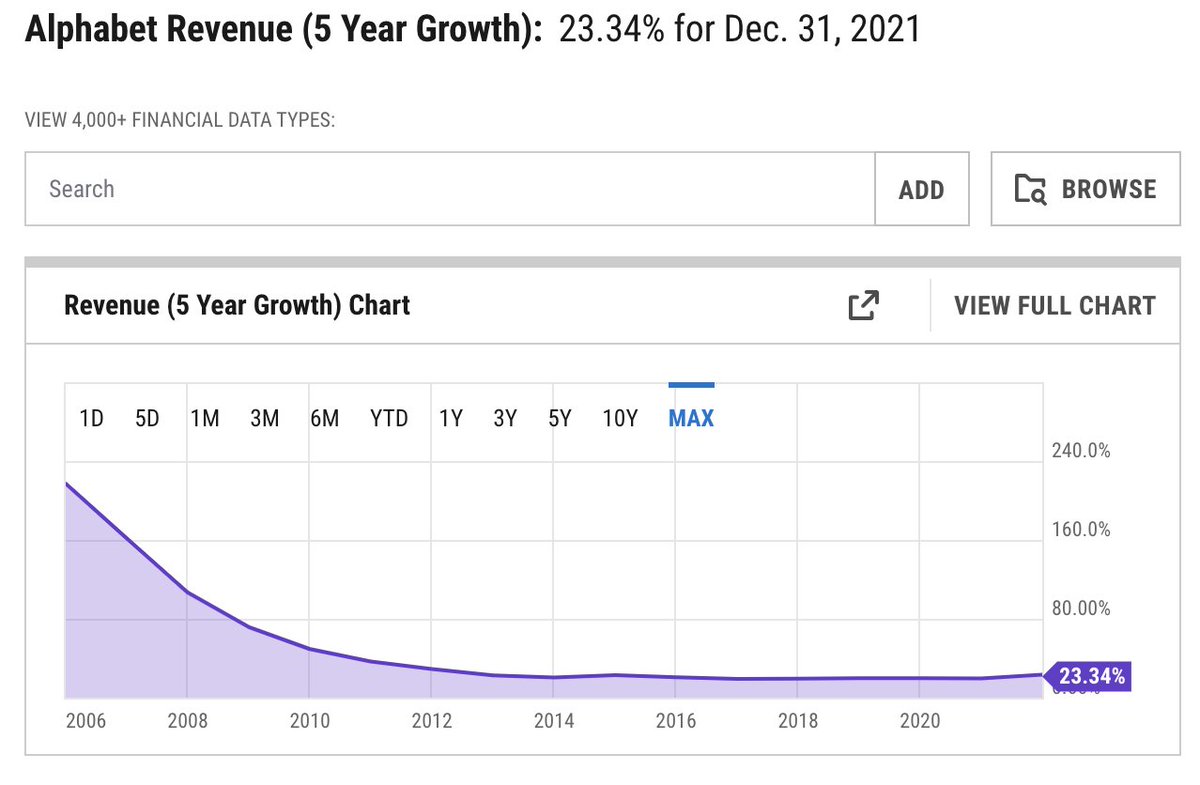

For older companies, like $GOOG, you can just look up the 5 year growth rate on YCharts or something like that:

But $SNOW hasn't been public that long. Even some of the pre-IPO income statement data isn't on services like YCharts yet. You can always get the data from the Investor Relations page of whatever company you are looking at.

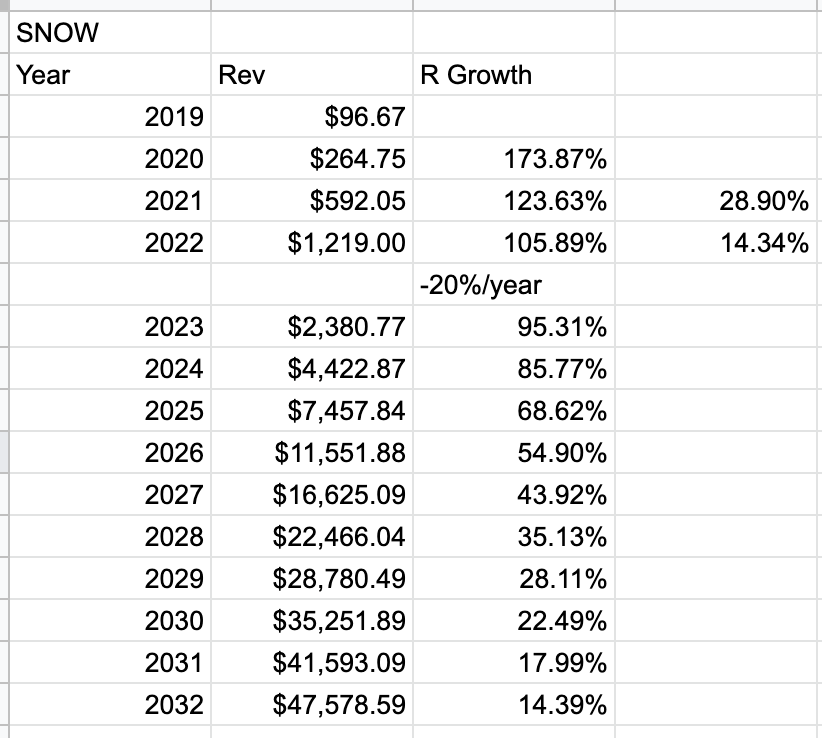

Here are the annual revenue numbers I found for $SNOW from 2019-2021: $96m, $264m, $592m, $1219m.

From these I can calculate the rev growth rate year by year. The #s in the 4th col are the % the growth rate is slowing by. Then I guess it might slow 20% per year, drag to 2032.

And we get a revenue estimate for $SNOW in 2032. $47.6b. That's close to the current market cap.

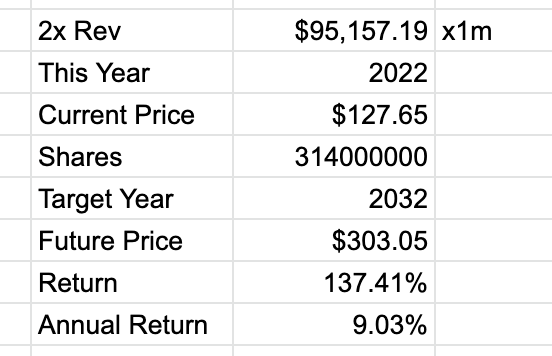

To figure out the stock price in 2032, we need to guess at a reasonable price to sales ratio for 2032 $SNOW.

2x is a conservative estimate. 4x mid. 6x aggressive.

Here's the math to figure out the future stock price in 2032. We basically take the future revenue, multiply by the sales ratio we guess, and then divide by the number of outstanding shares. Make sure to account for numbers in thousands or millions.

So based on these estimates, a good price for $SNOW in 2032 (10 years from now) is $303.05.

If you bought above that this past year, that sounds low. If you buy now, you're still getting a 9% annual return for the next 10 years.

If you think 2032 $SNOW will warrant a 4x price to sales ratio (similar to Google), then you can adjust the sheet to get the higher price. 4x sales would be $606 with our estimate, or 16% per year. This is a nicer return.

At this point, I personally would say $SNOW may be ready to start a position. Would be nice if it got cheaper.

Next steps for me are to listen to more earnings calls and get a better feel for the management, and try to do a better revenue estimate.

One way to do a better revenue estimate would be to create what I call a "main street" model. I would try to answer "WTF does Snowflake even sell, and how much money can they make doing that".

For someone like Netflix that's easier: 300m subs x $20/mo plan = $72b/year.

For Snowflake, which is such a young company and also establishing a whole new industry basically, that is going to be much harder, and will take more research.

But at this point, you want to get away from growth rates and multiples and talk more about customers and contracts.

So that's it. That's kind of my thought process for coming up with a fair value for a stock, and specifically a young company with high rev growth but no earnings.

Let me know if there are other stocks you'd like me to do similar analysis on.

Originally tweeted by Jason Coleman 🤔💡💻💾 (@jason_coleman) on Wednesday, Jun. 1, 2022.